CGMA® Finance Leadership Program in the UK

A new way to qualify

The CGMA Finance Leadership Program (FLP) is a guided, digital-first learning and assessment experience.

It’s your online route to the CIMA’s CGMA Professional Qualification and the Chartered Global Management Accountant® (CGMA) designation — the most relevant global finance qualification for a business career, held by more than 140,000 finance professionals worldwide.

A new way to qualify

The CGMA Finance Leadership Program (FLP) is a guided, digital-first learning and assessment experience.

It’s your online route to the CIMA’s CGMA Professional Qualification and the Chartered Global Management Accountant® (CGMA) designation — the most relevant global finance qualification for a business career, held by more than 140,000 finance professionals worldwide.

Fast-track your career in business and finance

The CGMA FLP lets you learn and master new business skills anywhere, anytime and at your own pace.

Fast-track your career in business and finance

The CGMA FLP lets you learn and master new business skills anywhere, anytime and at your own pace.

Flexible online learning

The CGMA FLP teaches the same competencies as other routes to CIMA's CGMA Professional Qualification. This prepares business and finance professionals for careers in management accounting. Candidates will be assessed on the same material and must demonstrate the same level of competency and experience to earn the CGMA designation and CIMA membership.

With the CGMA FLP, learning is part of an all-inclusive subscription package and delivered online in a self-paced digital environment. The CGMA FLP offers you the opportunity to both learn the material and sit online assessments at your speed. As there is no Objective Test (OT) exam date to schedule or work towards, you can study when you want, wherever you are, and even learn the topics in whichever order you like. Case study exams can be sat at an assessment centre or taken remotely online, thus creating a true digital learning experience.

Flexible online learning

The CGMA FLP teaches the same competencies as other routes to CIMA's CGMA Professional Qualification. This prepares business and finance professionals for careers in management accounting. Candidates will be assessed on the same material and must demonstrate the same level of competency and experience to earn the CGMA designation and CIMA membership.

With the CGMA FLP, learning is part of an all-inclusive subscription package and delivered online in a self-paced digital environment. The CGMA FLP offers you the opportunity to both learn the material and sit online assessments at your speed. As there is no Objective Test (OT) exam date to schedule or work towards, you can study when you want, wherever you are, and even learn the topics in whichever order you like. Case study exams can be sat at an assessment centre or taken remotely online, thus creating a true digital learning experience.

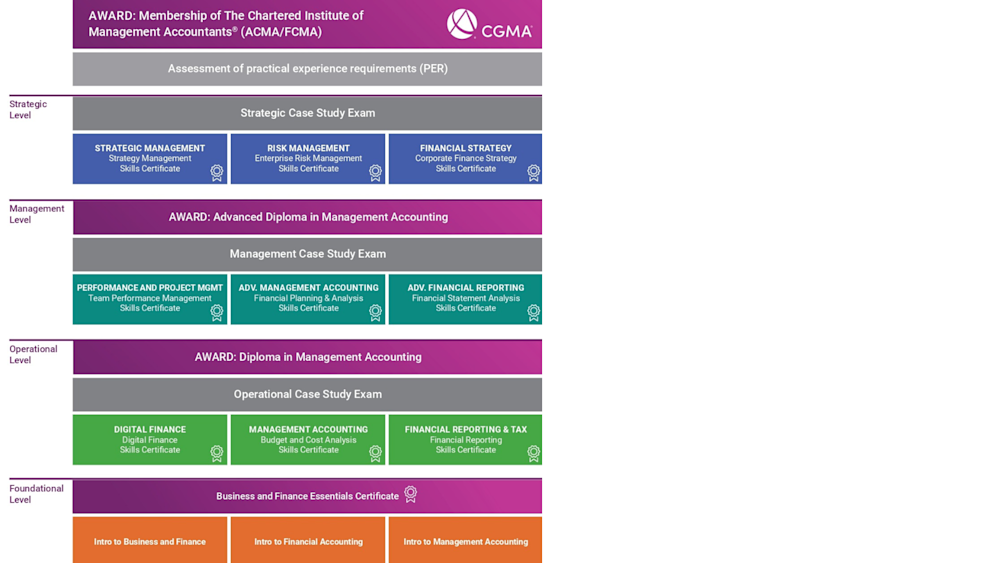

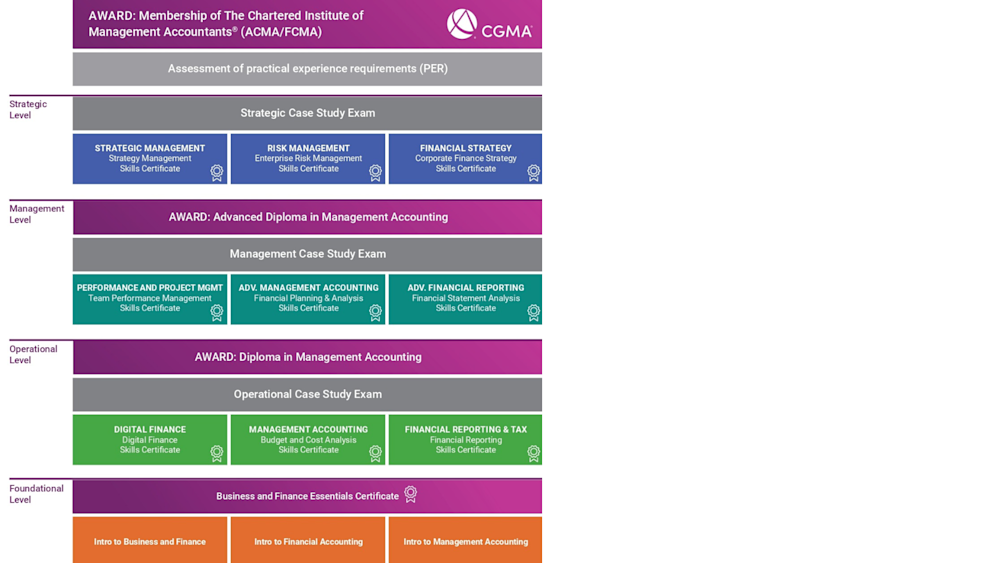

Curriculum

Review the curriculum to see skills, Certificates and Diplomas you’ll earn throughout the program.

Assessment of practical experience requirements (PER)

Foundational

The Foundational Level is a condensed introduction to the concepts of business and finance.

Business and Finance Essentials Skills Certificate

Introduction to Business and Finance Understand how a business functions and the wider business environment

Introduction to Financial Accounting Describe the financial accounting process and how financial statements are prepared

Introduction to Management Accounting Explain the role of management accounting and how it supports relevant decision-making

Kick-start your studies with our Study Guide to support every step of your journey. Watch this video to find out how we can help.

Access the full guide here, through your FLP Platform login.

Operational level

The Operational Level teaches essential business concepts and establishes a strong foundation in technical finance and accounting.

Digital Finance Skills Certificate

Finance Function Transformation— Understand the role and transformation of finance.

Finance Business Partnering— Explain main business functions and finance business partnering.

Data and Analytics— Identify how data-backed analysis supports decision-making.

Budget and Cost Analysis Skills Certificate

Short-Term Decision Making— Present information to support decision-making that considers uncertainty.

Cost Accounting— Apply cost accounting methods to planning, control and reporting.

Budgeting and Planning— Prepare and use budgets to impact planning and control.

Financial Reporting Skills Certificate

Regulatory Environment— Describe regulatory oversight, standard-setting and corporate governance processes.

Financial Statements— Apply financial reporting standards to prepare financial statements.

Principles of Taxation— Recognise key international taxation issues and prepare corporate tax calculations.

Managing Working Capital— Use short-term financing and working capital management techniques.

Diploma in Management Accounting

Receive your diploma after completing the Operational Level and the Operational Case Study.

Management level

At the Management Level, you’ll develop core skills and business acumen while acquiring more advanced tools and frameworks.

Team Performance Management Skills Certificate

Business Models— Recognise the dynamics of organisational ecosystems and business model frameworks.

Leading and Managing People— Apply management and leadership approaches that improve team performance.

Project Management— Apply project management tools and techniques that drive change.

Financial Planning and Analysis Skills Certificate

Cost Competitiveness— Advise on techniques to manage costs and achieve sustainable competitive advantage.

Organisational Performance— Manage performance of organisation units.

Pricing and Capital Investment Decisions— Support pricing strategies and capital investment decision making.

Decision Making and Risk— Identify and manage risk associated with decision making.

Financial Statement Analysis Skills Certificate

Advanced Financial Statements— Apply recognition, measurement and presentation criteria used in International Financial Reporting Standards.

Long-Term Financing— Advise on sources of long-term finance and associated costs.

Complex Group Reporting— Prepare financial statements according to relevant international accounting standards.

Financial Statement Analysis— Provide insights about financial performance and position.

Diploma in Advanced Management Accounting

Receive your diploma after completing the Management Learning Level and the Management Case Study.

Strategic level

In the Strategic Level, you’ll complete your finance professional skill set with new insights and a valuable toolkit to help you lead at the enterprise level.

Strategy Management Skills Certificate

Competitive Advantage— Advise on current position and long-term direction.

Strategy Formulation— Formulate and effectively present strategy to leadership.

Strategy Implementation— Evaluate the effectiveness of strategy implementation and the importance of change management.

Digital Strategy— Develop and implement enterprise-wide digital transformation.

Enterprise Risk Management Skills Certificate

Enterprise Risk Management— Identify, evaluate and manage enterprise risks.

Strategic Risk— Analyse risks associated with governance and strategy formulation.

Internal Control— Recommend and implement internal controls.

Cybersecurity— Anticipate cybersecurity threats and apply risk management techniques.

Corporate Finance Strategy Skills Certificate

Financial Policies and Objectives— Evaluate strategic goals and policy decisions.

Debt and Equity Finance— Analyse capital structure and strategic financing decisions.

Financial Risk — Assess and manage financial risks.

Business Valuation and Acquisitions — Evaluate decisions impacting business valuation and acquisitions

Chartered Global Management Accountant (CGMA) designation

After completing the Strategic Level, the Strategic Case Study and three or more years of verified, relevant, work-based practical experience, you can become a CGMA.

Finance Leadership Programme Video Series

In this video series, Jason answers the most frequently asked questions about the CGMA Finance Leadership Programme.

Finance Leadership Programme Video Series

In this video series, Jason answers the most frequently asked questions about the CGMA Finance Leadership Programme.

Who is eligible?

Anyone is able to start the program. Also, if you already have other academic or professional qualifications, or relevant professional experience, you may be exempt from certain elements of the program. Your exact exemptions and entry point to the program is determined during registration based on your specific background. The following are examples of entry points that some of our Candidates receive:

Education

Each degree is different, but accounting and finance degrees often qualify for entry at the management level, and business degrees often qualify for entry at the operational level.

Professional Qualification

Full members of IFAC-registered accounting bodies often qualify for entry at management level, and US CPAs qualify for entry at Strategic Case Study.

Work Experience

Direct, relevant experience in true accounting or finance roles may provide exemptions as well.

Subscription options

Our all-inclusive subscriptions have all the resources, tutorials, exams and assessments you need to complete CIMA’s CGMA Professional Qualification.

We have subscriptions for 1, 2 or 3 years which includes your registration, learning, exam preparation, assessments and exams.

Below details the different packages to suit your study needs:

Want to learn more about the CGMA Finance Leadership Program in the UK?

Complete the form here and a member of the team will be in touch shortly.

Want to learn more about the CGMA Finance Leadership Program in the UK?

Complete the form here and a member of the team will be in touch shortly.